EPRI has launched a new initiative — DCFlex — to explore how data centres can support the electric grid, enable better asset utilisation, and contribute to the clean energy transition. The initiative’s founding members include Compass Datacenters, Constellation Energy, Duke Energy, the Electric Reliability Council of Texas (ERCOT), Google, Meta, New York Power Authority, NRG Energy, NVIDIA, Pacific Gas and Electric Company (PG&E), PJM Interconnection, Portland General Electric, QTS Data Centers, Southern Company, and Vistra Corp.

After years of flat load growth on the US grid, electricity demand is rising across the economy as numerous factors – including industrial onshoring, electrification of transport, digitisation, and the adoption of AI – converge, EPRI notes.

This growing demand presents unique opportunities in the journey towards net zero and ensuring reliability across the electric grid, says EPRI. Technology companies have historically been a key driver in accelerating commercialisation of clean energy and innovative collaborations throughout the energy ecosystem. Their efforts and ambitions toward net-zero and clean energy in collaboration with electricity providers sharing these goals can be a driving force in addressing the growing demand and building a more reliable, resilient, affordable, and sustainable electricity grid of the future, EPRI believes.

Led by EPRI, DCFlex will co-ordinate real-world demonstrations of flexibility in a variety of existing and planned data centres and electricity markets, creating reference architectures and providing shared learnings to enable broader adoption of flexible operations that benefit all electricity consumers.

Specifically, DCFlex will establish five to ten flexibility hubs, demonstrating innovative data centre and power supplier strategies that enable operational and deployment flexibility, streamline grid integration, and transition backup power solutions to grid assets. Demonstration deployment will begin in the first half of 2025, and testing could last until 2027.

The initiative is an outgrowth of discussions with the US Department of Energy (DOE) and many in the data centre, technology, utility, and research communities that informed the development of recommendations to DOE from the Secretary’s Energy Advisory Board (SEAB) earlier this year (Powering AI and Data Center Infrastructure Recommendations July 2024 (energy.gov)). The recommendations highlighted the need for closer collaboration among all key stakeholders in powering the data centres that support the USA’s economy and underpin advances in AI technology.

For the electric sector, AI advances are key to managing the grid more efficiently by effectively integrating distributed resources, demand response, variable renewables, and energy storage with utility-scale grid resources. This can accelerate the energy transition while keeping electricity reliable and affordable.

“Data centres play a critical role in today’s interconnected global information-sharing environment and economy, but along with increased manufacturing and movement towards electrification, they are placing additional power needs on the electric grid,” said EPRI President and CEO Arshad Mansoor. “Flexible data centre design and operation is a key strategy for accelerating AI development and realising its benefits while minimizing costs, lowering carbon emissions, and enhancing system reliability.”

“Data centres are integral to our daily lives, economy, and national security. Our energy system is built to handle the extreme demands of our hottest summer days and coldest winter nights but is often underutilised. The real challenge isn’t a lack of energy for data centres but managing the peak demand hours. The ability of data centres to flex during these critical periods is crucial,” said Constellation President and CEO Joe Dominguez.

Analysing AI power demand

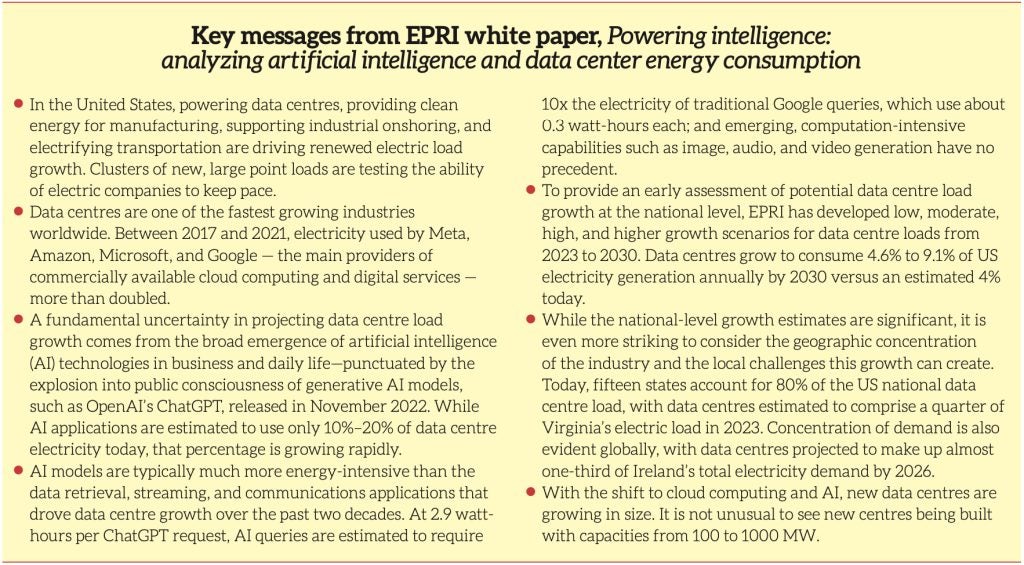

The DCFlex project has been launched as artificial intelligence becomes more entrenched in the 24/7 digital economy, with demand for power likely to surge. According to a recent EPRI white paper, Powering intelligence: analyzing artificial intelligence and data center energy consumption, electricity usage by hyperscale data centres more than doubled between 2017 and 2021. This increase is expected to continue, with data centres projected to consume 5% to 9% of US electricity generation annually by 2030, up from 4% today.

This could create regional supply challenges, among other issues.

According to the EPRI white paper, AI queries require approximately ten times the electricity required for traditional internet searches (0.3 watt-hours for a Google search, 2.9 watt-hours for a Chat- GPT query) and the generation of original music, photos, and videos requires much more. With 5.3 billion internet users, rapid adoption of these new tools could increase power demand substantially. At the same time, computing facilities are becoming more concentrated, with single facilities now requesting power consumption that can range from 100 MW to 1000 MW, exacerbating power delivery challenges.

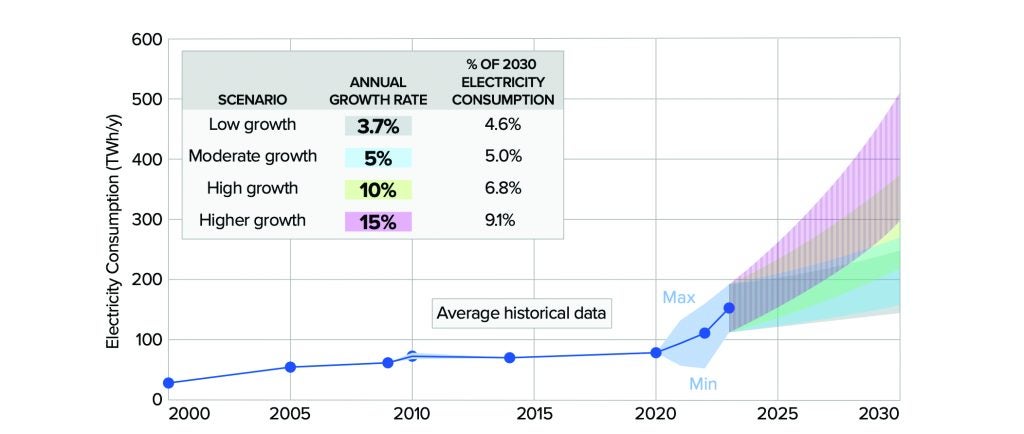

EPRI considers four scenarios for potential annual electricity consumption in US data centres over the period 2023 to 2030, with annual growth rates ranging from 3.7% to 15%. The lowest growth scenario assumed limited public uptake of AI tools, coupled with high gains in data centre efficiency, and the highest growth scenario combined rapid expansion of AI applications with fewer efficiency gains. These scenarios placed data centre power consumption as a percentage of total US consumption in the range 4.6%-9.1%.

“The US electricity sector is working hard to meet the growing demands of data centres, transportation electrification, crypto-mining, and industrial onshoring, while balancing decarbonisation efforts,” said EPRI Vice President of Electrification and Sustainable Energy Strategy David Porter. “The data centre boom requires closer collaboration between large data centre owners and developers, utilities, government, and other stakeholders to ensure that we can power the needs of AI while maintaining reliable, affordable power to all customers.”

The analysis also looked at regional impacts of increased AI power demand. An estimated 80% of the national data centre load in 2023 was concentrated in 15 states, led by Virginia and Texas. Demands for highly reliable power, requests for power from new, non-emitting generation sources, and short lead times for connection — of two years or less — can create local and regional electricity supply challenges, EPRI observes.

To overcome these challenges, the analysis suggested three essential strategies:

- Improve data centre efficiency and flexibility.

- Co-ordinate closely between data centre developers and utilities regarding power needs, timing, flexibility, and delivery constraints.

- Develop better modelling tools to anticipate and accommodate data centre growth without affecting grid reliability.

To address the need for better modelling tools, EPRI recently launched a comprehensive, two-year programme to examine and develop new strategies for meeting emerging operational and planning load forecasting challenges. One key focus is on projections of large loads such as data centres. The initiative is exploring better approaches for forecasting load during extreme weather events, estimating customer deployment of distributed energy resources, changing customer behaviour, and the impacts of emerging technologies.

The blue line in the figure, running from 2000 to 2020, traces historical data centre electricity consumption estimates. From 2000 to 2010, data centre load grew as centres expanded across the USA to support the emerging internet. From 2010 to 2017, despite continued growth in computing demands and data storage this load growth flattened due to efficiency gains and the replacement of small, relatively inefficient corporate data centres with large, cloud computing facilities. In recent years, load growth has accelerated, driven by emerging AI applications and COVID-era increases in demand for services like streaming and video conferencing. The light blue area highlights uncertainty in a range of data centre electricity consumption estimates for 2021 to 2023. Coloured bands show four projections, which combine estimates of increased data processing needs with assumptions about efficiency gains:

- Low growth — 3.7% annual load growth based on a Statista projection of data centre financial growth issued prior to the release of ChatGPT.

- Moderate growth — 5% annual load growth based on an expert assessment commissioned by EPRI.

- High growth — 10% annual load growth consistent with both a McKinsey estimate and another expert assessment commissioned by EPRI in summer 2023.

- Higher growth — 15% annual growth based upon a commissioned expert assessment consistent with rapid expansion of AI applications and limited efficiency gains.

(Source: EPRI)