Exuberance about the massive strides made in adding wind and solar to the grid may have led the pendulum to swing a little too far. The previous mayor of Los Angeles, for example, nixed investment in the modernisation of the city’s many natural gas generation assets proclaiming that renewables were the future. That may be so, but his action will probably come to be regarded as a historic blunder. Those assets remain vital to the grid, perhaps even more so today. Yet failure to modernise them means these units will continue, for the foreseeable future, to belch three or four times more emissions than modern gas turbines. Further, some units remain unable to provide the fast-response peaking power that the California Duck Curve requires – rapid fall off of solar power in the late afternoon requiring a lot of natural-gas based plants to come online rapidly to cope with peak demand in the early evening.

But the times they may be a-changing. Utilities in the USA and Australia, among others, are quietly issuing grid modernisation plans that marry huge additions of wind and solar with plans for new power plants or major upgrades to existing gas generation facilities.

No stopping the renewable juggernaut

According to data tracked by Industrial Info Resources (IIR), renewable energy continues to dominate the outlook for US new-build power-generation projects scheduled to begin construction over the 2024-2028 period.

“94% of all new-build power generation projects scheduled to begin construction in the United States between January 2024 and December 2028 will be for renewable energy,” said Britt Burt, an analyst at IIR. “Developers plan to build about 482 GW of new generation by 2028.”

There is no question, then, that more renewables are destined to flood onto the grid for some time to come. Most natural gas advocates don’t dispute this. They argue that the wind and solar lobby’s insistence of the entire phase out of gas is ill-advised. In fact, some contend that hissy fits over any natural gas construction, modernisation or pipeline expansion will directly inhibit the goal of achieving a stable renewable-heavy grid.

Mark Axford of Axford Consulting, cites the old adage, “haste makes waste.” He believes not enough attention is being paid to the price of electricity.

A deafening cry to close down all fossil fuel assets at once, even relatively new ones that have achieved low levels of emissions, drives up cost and makes it appear that renewable generation is more expensive than it us. Utilities sunk millions into these gas assets and calculate the return on their investment over their complete lifecycle.

“To declare clean, natural gas plants to be stranded assets before the end of their economic life is wasteful and expensive,” said Axford. “If ratepayers abandon a natural gas generation plant after only 15 years of a 20-year life, the ratepayers are not excused from paying off the remaining five years of construction and capital costs.”

But reliability may be a larger cost in the long run. A more calculated energy transition with supplemental, dispatchable gas generation could stiffen the grid and improve reliability. This is particularly relevant in locations where additional transmission lines are not economically or environmentally feasible, or where it will take years for new transmission lines to be able to carry wind and solar power to load centres.

“A more gradual transition allows time for innovative technologies to evolve, thereby reducing cost and improving efficiency of offshore wind, battery storage and carbon capture,” said Axford.

However, there are a few areas of the world that are adopting policies that advance gas generation in the name of a creating the stable renewable grid of the future. Let’s take a closer look at Texas, Tennessee and Queensland, Australia.

Texas

Texas leads the USA in most categories. It has close to 40 GW of wind and more than 15 GW of solar. Yet the Lone Star State also leads the USA in new natural gas plant construction. A company named WattBridge Energy, for example, has established a network of about 40 gas turbine plants, all of them using the GE Vernova LM6000 aeroderivative turbine. These are fast start, low-emission peaking units that provide power when there is a lack of wind and solar, as well as grid resilience and greater energy security.

The latest example is the Brotman generating station in Brazoria County, Texas, bringing the total of the company’s Electric Reliability Council of Texas (ERCOT) zone portfolio to 1.8 GW. The company is now expanding across the USA and internationally.

“We have 2400 MW operational or under construction and at least 1600 MW in advanced development that could be online by 2026,” said WattBridge President, Mike Alvarado.

The Texas legislature is rare in that it provides funding for wind, solar, and natural gas. A new bill created a $10 billion fund to support the construction of new gas-fired generation, as well as the modernisation of existing gas-fired generators.

“Texas politicians and the state’s grid operator, ERCOT, have been advocating for an increase in gas-fired, generation to ensure the lights stay on during weather extremes,” said Burt.

Tennessee

Natural gas accounted for about 41% of the electricity generated in 2023 in the USA and the forecast is also for around 40% in 2024, according to the US Energy Information Administration (EIA). Beyond Texas, states like Montana, Wyoming and Tennessee are keen to add more gas generation.

The Tennessee Valley Authority (TVA), for example, has an aggressive renewable programme ongoing with 1 GW of wind and solar PV destined for the state over the next couple of years.

In parallel, aging coal plants are being decommissioned while older gas turbine facilities are largely being retained for peaking power and grid support. Further, a great many new plants are under construction or ordered. TVA has received ten GE LM6000 PF+ gas turbine generators for new facilities and has another 20 on order.

Sixteen of these units are destined for the Kingston Energy Complex, which is being built on the site of a coal plant that will be shuttered by 2027. It will supply up to 850 MW of electricity and enhance grid reliability. The site will also host 100 MW of onsite battery storage and 4 MW of solar generation.

“The Kingston Energy Complex highlights the way diverse generation works together to ensure TVA can provide more reliable, resilient and affordable power,” said TVA Chief Operating Officer Don Moul. “These aeroderivative units will help us meet demand during peak energy usage and supplement solar generation on days when sunshine is limited.”

These GE Vernova units are slated to begin operation in 2028. They include a dual-fuel capability to run on natural gas or liquid fuels when required. The dry low emissions (DLE) combustor configuration can meet emissions limits in compliance with the regional air district requirements and avoids water consumption for NOx emissions abatement. LM6000 gas turbines take five minutes to reach full power and are designed for frequent cycling so they can withstand the rapid starts and stops required to complement renewables.

The Kingston project follows earlier LM6000 installations such as those at TVA’s Johnsonville plant in 2023. The plan is for TVA to add 3.8 GW of natural gas generation to the grid between 2023 and 2028.

“Many of TVA’s new combustion turbines are replacing older, less efficient units,” said Jamie Cook, TVA’s General Manager of Major Projects. “We can operate natural gas units when other sources of generation aren’t available. They supplement those sources with reliable power when we need it most.”

These units are being fitted for double duty. At the end of the day or under cloudy conditions, natural gas power is needed fast when solar output declines. Additionally, many of these rotating assets serve as synchronous condensers. As TVA understands the need for grid stability, its planning for the Kingston plant includes maintaining reserve margins by providing transmission system voltage support to the local area to maintain system stability and reliability.

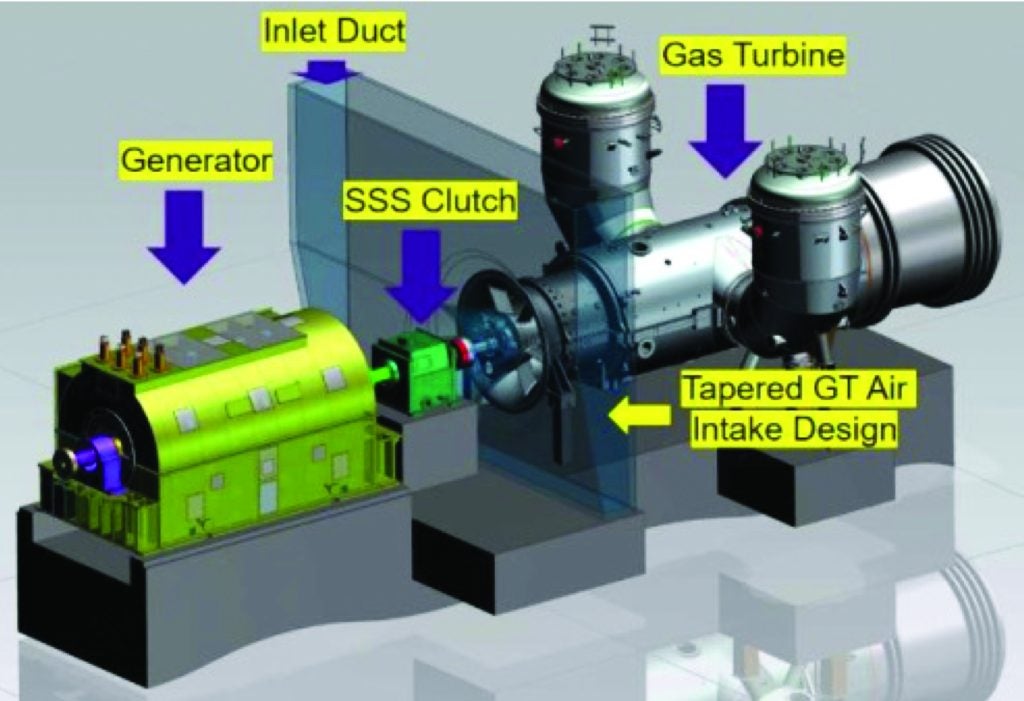

Accordingly, the company has ordered clutches for each LM6000 PF+ from SSS Clutch Co. These clutches are built into a load gear as the gas turbine operates at a higher speed than the generator at 3600 rpm. The gear is needed to create synchronisation with the grid.

“By enabling these LM6000s to run as synchronous condensers, TVA is ensuring it has enough inertia, system stability and reactive power support,” said Morgan Hendry, President of SSS Clutch Co. “Regulators and utilities are starting to realise the folly of retiring natural gas generation assets when they are vitally needed for peaking power and grid stability.”

Queensland

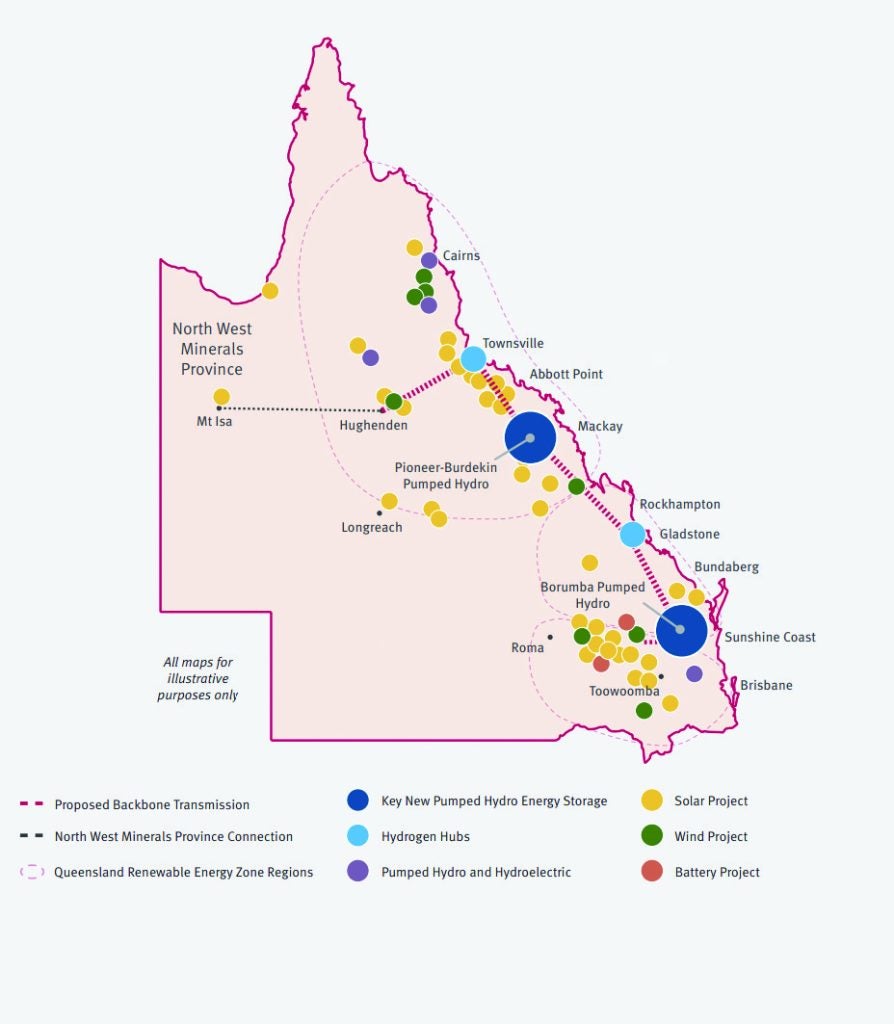

The Australian state of Queensland generates 70% of its electricity from coal today. It has unveiled plans to be 70% renewable-powered by 2032. That requires the phase out of 8.1 GW of coal while building 25 GW of large-scale wind and solar, 7 GW of rooftop solar, 3 GW of battery storage, 6 GW of pumped hydro storage (PHS), 3 GW of new gas generation and a considerable upgrade to its transmission network to create what is to be known as the Queensland SuperGrid. Government reports stress the need to support wind and solar assets with large amounts of synchronous condensing to provide system strength, grid stability and reactive power.

“Australia needs strong grids to meet its 2030 decarbonisation goals,” said Darren John Garwood, Head of Field Sales Pacific Region, Siemens Energy Gas Services Australia. “Ratch-Australia Corp’s Townsville power station will contribute to grid stability by converting its gas turbine and generator to a hybrid rotating grid stabiliser (RGS). It can instantly switch from power generation to grid stabilisation mode, preventing potential blackouts.”

The northern town of Townsville lies at the heart of much of the work. Stronger transmission lines are being installed. A 750 km, 500 kV line will connect it to a new PHS facility and other energy assets to the south. Another 370 km, 500 kV line will connect to the Hughenden wind and solar complex to the west.

System strength is a major concern. The Australian Renewable Energy Agency (ARENA) published a report highlighting requirements for system strength and inertia services to manage power system security, in which it said:

“Retirement of fossil-fuel generation, particularly large coal-fired power stations, is projected to reduce both system strength and inertia. The international energy transition and adoption of more inverter-based renewable generation is driving international demand for large synchronous condensers (SCs). One possible solution is to convert existing fossil-fueled generators, which are synchronous machines, into SCs. At face value, this should provide a cost-effective way of providing the required security services.”

As a result, the Australian Energy Market Operator (AEMO) requires grid operators like Powerlink to provide a minimum fault level, procure system strength and add inertia as part of any transmission modernisation efforts. System strength ensures the power system can maintain a stable voltage waveform, even after a disturbance. Inertia allows the power system to resist large changes in frequency arising from an imbalance in supply and demand after a disturbance.

Under the new framework, parties that submit an application to connect must choose to:

- Remediate their system strength impact.

- Or pay for their use of system strength resources procured by the grid operator.

This requirement led Powerlink to meet with Townsville power station owner Ratch to discuss options for a facility that includes a 160 MW Siemens Energy SGT5-2000E gas turbine and an 82 MW heat recovery steam generator (HRSG). After reviewing eight possible solutions, Powerlink concluded that the least-cost option to address system strength services was the addition of a clutch to the shaft between the Siemens Energy gas turbine and the generator, to be carried out during a scheduled major outage in 2025.

“Replacing the intermediate shaft of the gas turbine with a Synchro-Self-Shifting (SSS) clutch will provide an instantaneous switch from power generation to synchronous condenser mode,” said Garwood.

When in synchronous condenser mode, the RGS unit can provide rotating inertia and 350 to 400 MVA of short-circuit power without the need to produce power. The electrical inertia while operating in the grid stabilisation mode is calculated to be around 250 megawatt seconds (MW.s) and around 1000 MW.s while operating in power generation mode. Plant owner Ratch-Australia gains a new revenue stream from providing these additional grid services.

“This modification is cheaper and faster than a greenfield dedicated synchronous condenser and provides our gas turbine customers with an additional revenue stream,” said Garwood. “It allows one unit to fulfill two roles: to operate as a power generator as it always has (clutch closed); or operate as a synchronous condenser when power generation is not required (clutch open and GT not operating).”

Grid support: a niche for gas turbines

The history of technology has many examples of the new trying to get rid of the old a little too rapidly. The mainframe computer was “dead” in the mid nineties according to Microsoft and IT analyst firm Gartner. Yet it remains very much alive and well inside large corporations as the best technology for very high-end transactional processing systems. Similarly, tape-based storage was killed off by disk more than twenty years ago, according to disk advocates. Yet more tape is being used today than ever, primarily for long-term archiving of large quantities of data.

The moral of the story is that the old may lose ground to newer technologies, but they usually find a niche in which they continue to add value for some time to come. This is the case with the new of renewables and the old of gas turbines. Yes, renewables can and will prevail. But if advocates insist on the elimination of any and all natural gas generation assets, they will only destabilise the grid, drive up costs and potentially cause rolling blackouts. The evolving role of the gas turbine, then, is to provide reliable backup and peaking generation and to offer grid support that makes it possible for more and more renewables to come onto the grid.

“The transition to more renewable energy is a balancing act between sustainability, reliability and affordability and is best thought of as a marathon, not a drag race,” says Axford.