Over the last several years, the Japanese government has announced energy policies aimed at achieving carbon neutrality, or net-zero greenhouse gas (GHG) emissions, by 2050 by lowering emissions in the electric power, industrial, and transportation sectors. In the electric power sector, government policies set 2030 targets, which include accelerated investment in renewable generating capacity, increased use of nuclear generation, and reduced use of fossil fuels for electricity generation. Japan’s government called the package of energy policies and their targets “ambitious.” Energy security considerations may affect the progress and pace of decarbonisation in the electric power sector.

Electric power sector policies

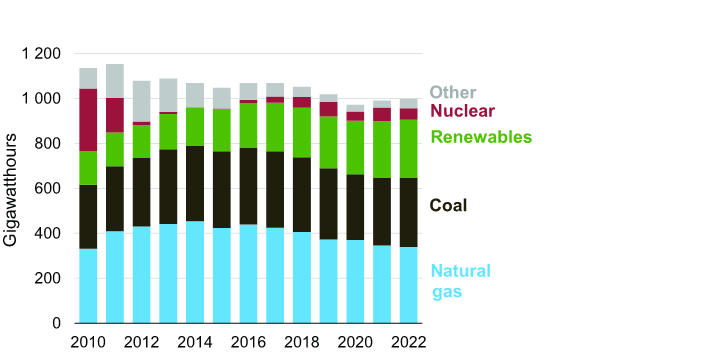

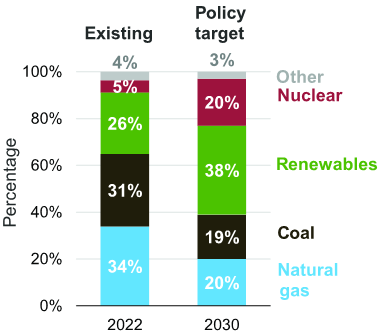

Japan’s 6th Strategic Energy Plan (released in 2021) and the GX (Green Transformation) Decarbonization Power Supply Bill (released in 2023) target increasing the share of non-fossil fuel generation sources to 59% of the generation mix by 2030 compared with 31% in 2022. Policies target an increase in the share of renewable generation sources including solar, wind, hydropower, geothermal, and biomass from 26% in 2022 to 36%–38% by 2030 and an increase in the share of nuclear generation from 5% in 2022 to 20%–22% by 2030.

Power generation employing fossil fuels (natural gas, coal, and petroleum) is set to decline from 69% in 2022 to 41% by 2030. The policies also could expand hydrogen and ammonia use in natural gas and coal co-fired power generation, in difficult-to-electrify end-use sectors, and in advanced carbon capture and storage technology development.

Renewable energy resources

From 2018 to 2022, the share of renewable generation in Japan grew from 21% to 26%. Policies to increase its share are to be supported by:

- establishing renewable energy promotion zones (zones that meet specific criteria for developing renewable energy projects and that provide investment and licensing benefits);

- increasing investments in research and development focused on technology advancements, particularly in solar and wind;

- accelerating development of offshore wind projects; and

- stimulating growth in the renewable capacity buildout through other initiatives.

The targeted increase in renewable generation is paired with broad encouragement of battery storage. According to Japan’s 6th Strategic Energy Plan, battery storage will be increased as a distributed source of electricity closer to end users and within microgrids.

This new policy calls for an increase in installed solar capacity from 79 GW in 2022 to 108 GW by 2030. Initiatives include installing solar capacity on 50% of government buildings (6 GW), on corporate buildings and parking garages (10 GW), and on public land and promotion areas (4 GW). The targeted increase in Japan’s wind capacity focuses on increasing offshore installed capacity from 0.14 GW in 2022 to 10 GW by 2030. In March 2024, the Japanese government approved a draft amendment to allow offshore wind turbines to be installed in Japan’s exclusive economic zone.

Nuclear power

From 2018 to 2022, nuclear power’s share remained at about 5% of total generation in Japan. Lawmakers approved the GX Decarbonization Power Supply Bill, which effectively maintains existing legal provisions that allow nuclear reactors to operate beyond the 40-year licence to 60 years of operation. The bill also designated nuclear power as a main component of the country’s baseload electricity generation. Japan intends to maximise the use of existing reactors by restarting as many units as possible.

Japan’s government has encouraged a collaborative effort between manufacturers and electric utilities to develop next-generation reactors, signalling a sustained role for nuclear power in Japan’s electricity mix.

Before 2011, nuclear power accounted for about 30% of Japan’s electricity mix (with some 54 reactors in operation), and the government had planned to increase that share to over 40% by 2017. After the 2011 Fukushima Daiichi accident, the Japanese government suspended operation of all nuclear reactors for mandatory inspections and safety upgrades. The reactors were systematically taken offline during planned refuelling and maintenance outages; the last two units were suspended in 2013.

Nuclear restarts have proceeded slowly since the first two units were restarted in 2015. This hesitancy reflects, among other factors, continued public safety concerns, local court injunctions, comprehensive safety inspections, and lengthy authorisation processes within changing regulatory requirements.

Japan has restarted 12 reactors and expects to restart two more units in 2024. Chugoku Electric Power Company hopes to restart Shimane unit 2, located in the Matsue Prefecture, before the end of the year. Tohoku Electric Power has announced plans to restart Onagawa unit 2 in the Miyagi Prefecture of north eastern Japan in September.

The Energy Information Administration estimates that 24 GW of operating nuclear capacity will be required for nuclear generation to meet the policy target of 20% to 22% of total generation by 2030. By the end of 2024, a total of 12.6 GW of nuclear generating capacity is expected to be in operation. An additional 11.4 GW of nuclear capacity will need to be restarted between 2025 and 2030 to meet the policy target.

Liquefied natural gas (LNG)

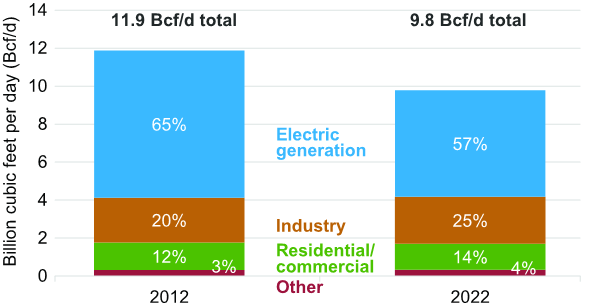

Policies target reducing the share of natural-gas-fired generation in Japan’s power generation from 34% in 2022 to 20% by 2030. The electric power and industrial sectors are the largest consumers of natural gas in Japan, accounting for 82% of all natural gas consumed there in 2022. Following the 2011 Fukushima Daiichi accident and the subsequent shutdown of nuclear reactors, use of LNG in the electric power sector increased from 5.8 billion cubic feet per day (Bcf/d) in 2010 to 7.8 Bcf/d by 2012. However, since 2019, LNG consumption in the electric power sector has been declining as more of Japan’s nuclear capacity has returned to service.

In 2022, less natural gas was consumed in Japan than in 2009, mainly because of slower economic growth, less industrial demand, high international LNG prices, and continued improvements in energy efficiency. The Energy Information Administration expects the decline in natural gas consumption in the electric power sector to continue.

Although LNG consumption has declined in recent years, LNG is expected to continue to play a significant role in Japan’s power generation mix over the mid-term. Natural-gas-fired generation accounted for 34% of generation in 2022 — the largest share of any fuel — followed by coal at 31%. As coal plant retirements continue and more electricity is generated from renewable sources, natural-gas-fired power plants will continue to provide load-following power supply to compensate for the intermittent nature of renewable generation, says the Energy Information Administration.

Japan’s ample natural gas storage capacity contributes to the country’s energy security by helping to meet seasonal demand peaks and ensuring that natural gas remains available in case of interruption in global LNG supplies.

Japan does not have international pipeline interconnections and imports about 98% of its natural gas in the form of LNG. LNG intended for consumption and additional volumes designated as reserves or inventory are stored in above-ground cryogenic storage tanks co-located at more than 30 of Japan’s LNG import terminals. Japan has the world’s largest LNG storage capacity, estimated to total 425.1 billion cubic feet of natural gas according to data from GIIGNL (International Group of LNG Importers).

Liquefied natural gas stored in tanks as reserves or inventory can be used if LNG imports from global suppliers are interrupted. The Energy Information Administration estimates that from 2009 to 2023, Japan’s LNG inventory varied between 32% and 66% of available LNG storage capacity.

Japan’s LNG storage capacity exceeds average monthly consumption to meet peaks in seasonal demand. The balance between LNG imports, consumption, and inventory is closely monitored and continuously optimised because LNG gradually evaporates even under the most favourable ambient conditions during storage in cryogenic tanks.

Coal and petroleum

Policies in Japan target reducing the share of coal in power generation from 31% in 2022 to 19% by 2030 and the share of petroleum generation from 4% in 2022 to 2% by 2030. This target extends policies announced in 2020 to phase out old and inefficient coal units. The policies also focus on rapid development of technologies aimed at reducing emissions from coal, including integrated gasification combined cycle, carbon capture and sequestration, and fuel blending with ammonia and biomass.

Japan’s government announced that it intends to review rules for power grid use to prioritise renewable electricity generation over coal-fired electricity generation. In 2023, Japan’s government announced that all new coal-fired power plants must have very stringent emission reduction measures in place.

Japan plans to close or suspend around 90% of the existing coal-fired power plants that have been deemed inefficient: approximately 100 facilities. Although specifics regarding these criteria and a list of coal plants that are considered inefficient have not been made public, it’s likely the facilities will include older plants that use subcritical technologies and less efficient supercritical systems. Based on such a cutoff, the Energy Information Administration suggests that the 100 oldest facilities (approximately 24 GW of coal-fired capacity) could close or suspend operations. This policy would reduce Japan’s total installed coal capacity by about 40%. Only 1.2 GW of new coal capacity is currently under construction.

Two proposals are being considered to help keep up to 12 GW of existing coal-fired capacity operational after 2030. They include adding 20% or more ammonia to the coal supply or blending 25% or more wood pellets into the coal boilers to help lower CO2 emissions and keep the plants open. The wood pellet programme is well underway, but the use of ammonia is still being tested.

Japan’s Ministry of Economy, Trade, and Industry (METI) is offering a feed-in-tariff (FIT) that pays owners of coal-fired plants for every kilowatthour generated by wood pellets in a coal boiler. The FIT is offered for 20 years. The programme has resulted in more than 3 million tons of wood pellets being imported in 2023, an amount likely to increase in the future. To qualify for the FIT, METI requires that generators keep lifecycle greenhouse gas emissions under certain limits.

The pace of coal retirements actually achieved under Japan’s phaseout plan will depend on several factors, including:

- addition of nuclear capacity through restarts and new facility additions;

- growth in renewables (both wind and solar) beyond what is currently in development; and

- the ability to balance the power grid as renewable generation grows.

* Source: Today in Energy, US Energy Information Administration, 2 May 2024 (https://www.eia.gov/todayinenergy/detail.php?id=61944).

Principal contributors: Victoria Zaretskaya, Jonathan Russo, Slade Johnson