A notable setback was Urenco’s announcement that it had “refocused its priorities” and could no longer support development of the U-Battery micro-reactor, having “exhausted…attempts to secure the commitment of new commercial investors.” Urenco’s plan is to “preserve the public investment in U-Battery by transferring its intellectual property to the National Nuclear Laboratory.”

The U-Battery is a 4 MWe/10 MWt HTGR (high temperature gas-cooled reactor) building on a conceptual design developed in 2009 by the Universities of Manchester (UK) and Delft (the Netherlands).

“We continue to believe in the U-Battery design,” said Urenco CTO Chris Chater, noting that it “could provide an innovative decarbonisation solution for hard to abate sectors…As such, we plan to support AMR and SMR designs like U-Battery in the future through fuel development, which we are investing in as part of our business strategy.”

Another step forward for Rolls-Royce SMR

Better UK news comes from Rolls-Royce SMR.

Its SMR, supported by 210 million GBP grant funding from UKRI (UK Research and Innovation), has progressed to Step 2 of the Generic Design Assessment (GDA), following successful completion of the first step of the assessment by the UK’s nuclear regulators.

“Reaching this significant milestone puts the Rolls-Royce SMR significantly ahead of other designs in securing consent for a small modular reactor to operate in the UK”, the company says.

The Rolls-Royce SMR, at 470 MWe – perhaps at the limits of what might be considered small – is a compact, 90% factory built, 3-loop PWR, building on the company’s extensive experience of providing technology for nuclear submarines.

Step 2 is the fundamental assessment stage of the GDA where the detailed technical assessment by the UK regulators – the Office for Nuclear Regulation, Environment Agency and Natural Resources Wales – is said to begin in earnest.

The aim of the UKRI funding is to accelerate the Rolls-Royce SMR design process and pass GDA stage 2.

Rolls-Royce SMR says it welcomes comments and questions about the Rolls-Royce SMR design. This feedback will be incorporated into the GDA process and may be published anonymously on the Rolls-Royce SMR GDA website and used during dialogue with our regulators.

Step 1 of the Rolls-Royce SMR GDA began in April 2022. Step 2 started a year later and is expected to last for 16 months.

The aim of the GDA is to allow UK regulators to begin assessing the safety, security, safeguards and environmental aspects of new reactor designs before site-specific proposals are brought forward.

The GDA process focuses on the design of a generic nuclear power station and is not site-specific. The end of Step 3 culminates in the award of a Design Acceptance Confirmation (DAC) or Statement of Design Acceptability (SoDA), but does not guarantee the granting of a site licence.

Rolls-Royce SMR has been established as an independent company, the investors being BNF Resources, Constellation (formerly Exelon Generation), and Qatar Investment Authority, as well as Rolls-Royce. These investors have assigned about 280 million GBP to the SMR development effort so far. Companies involved/ previously involved in development work include Arup, Assystem, Atkins, BAM Nuttall, Jacobs, Laing O’Rourke, NNL, Nuclear AMRC, Siemens, SNC Lavalin, TWI, Wood, as well as Rolls-Royce.

Other recent significant steps reported by Rolls-Royce SMR include: the signing of an MoU with Energoatom with a view to deploying Rolls-Royce SMRs in the Ukraine when the country begins its re-build; an MoU with Fortum focused on exploring opportunities in Finland and in Sweden; a memorandum of intent signed with Polish industrial group, Industria; and plans under discussion with CEZ for a fleet of SMRs in the Czech Republic, making use of Skoda JS and Doosan Skoda Power manufacturing facilities in Pilsen.

And the last shall be first?

With the UK government’s Future Nuclear Enabling Fund offering to contribute towards the cost of GDA, the UK regulators now find themselves considering a number of potential SMR applicants wanting to enter the GDA process.

Reactor concepts in the GDA pre-application phase include the following:

- GE Hitachi BWRX-300, a 300 MWe water-cooled, natural circulation BWR, with passive safety systems adapted from the US-licenced ESBWR.

- Holtec SMR-160, 160 MWe PWR developed in collaboration with Mitsubishi and Hyundai.

- X-energy pebble bed high temperature gas cooled reactor being developed for potential UK applications in collaboration with Cavendish Nuclear.

- Newcleo UK–Italian lead-cooled fast reactor.

- UK Atomics/Copenhagen Atomics containerised thorium molten salt reactor.

- GMET NuCell reactor, with production to be based at TSP Engineering’s facility in Workington, Cumbria, UK.

One would-be SMR provider decidedly not on this list is newcomer Last Energy, which is proposing what it calls PWR-20, a single loop 20 MWe/60 MWt PWR employing proven pressurised water reactor technology. It says it has “decided not to pursue a GDA route.” Instead “we are going directly for site licensing as we believe that this is the quickest route to get our product to market.”

Instead of having a ‘generic’ design and safety case assessed, followed by a re-iteration for a specific site (as is the case for Hinkley Point C, for example), Last Energy plans to request that the design and safety case are assessed as part of the normal site licence application. “This is in line with ONR guidance”, the company maintains, although different from other projects, and notes that “due to using a standardised design that does not differ by implementation or site, most of the site specific assessment will be applicable for any subsequent sites.”

A spokesperson for the UK Office for Nuclear Regulation said: “GDA is not a mandatory process but, because of its inherent benefits, it is expected that it will usually be requested for new nuclear power plants. GDA is aimed at providing confidence that the proposed design is capable of being constructed, operated and decommissioned in accordance with the standards of safety, security and environmental protection required in Great Britain. For the organisation requesting the GDA, this offers a reduction in uncertainty and project risk ahead of potential future licensing, permitting, construction and regulatory activities. GDA is not a substitute for the nuclear site licensing process but it will make a significant contribution to our assessment of the future site-specific safety case.”

Last Energy notes that “GDA is often used to help de-risk gigawatt scale projects but our projects require smaller amounts of financing and so investors are content to carry that risk. We are also not using new technology – and that’s a point of difference for us.”

Last Energy describes itself as “an energy-as-service provider”, aiming to “design, build, finance, and operate and service its power plants”, providing power to customers “who are looking for long term power contracts for carbon free electricity and heat.”

Last Energy say it is working with the regulatory authorities in the UK to seek the required regulatory approvals for its nuclear site licence, as well as planning permissions, and has had “successful pre-licensing discussions.”

US-based Last Energy can certainly not be accused of lacking optimism and ambition.

Remarkably, it says it has recently agreed USD $18.9 billion worth of power purchase agreements for 34 of its proposed PWR-20 power plants, ten planned for the Katowicka Special Economic Zone (KSSE) in Poland and 24 in the UK under three new partnerships representing a “diversity of UK industries, including a life sciences campus, sustainable fuels manufacturer, and a developer of hyperscale data centres.”

Details not yet revealed, but, remarkably, Last Energy is targeting 2026 as the commissioning date for its first power plants to come on line, which would seem a very tall order.

“By providing clean, on-site baseload electricity and heat to industrial partners, Last Energy’s PWR-20 micro nuclear power plant fills a critical gap for heavy energy users as they seek a reliable solution for rapid decarbonisation”, the company believes.

Rather than requiring government financing for new nuclear development, Last Energy says it is leveraging private capital looking to invest in clean energy and infrastructure projects.

“Our vision is to create a new model for what’s possible with nuclear development at scale, and you’re seeing it quickly come to life through these partnerships,” says Last Energy CEO, ‘Titans of Nuclear’ podcaster and tech entrepreneur, Bret Kugelmass. “For too long, nuclear has been too big, too costly, and failed to create a product that meets customer demand. From the outset, we started with studying our customer’s energy requirements, and we designed our power plant, and our entire business model, around delivering them what they need.”

Last Energy says it is not planning to use new fuels, new reactor designs, new physics or material sciences. Instead, it is focused on “standard PWR technology” – albeit considerably scaled down – with forced circulation primary cooling and standard full length “off the shelf” fuel (standard UO2 pellets at <4.95% enrichment, with 3 month planned refuelling outage every 72 months).

The result is “a very simple reactor design’, says Last Energy, with very short estimated lead times, 24 months from FID to completion, project costs below $100 million, on-site construction work duration three months.

The PWR-20 power plant would employ air cooling, minimising water requirements.

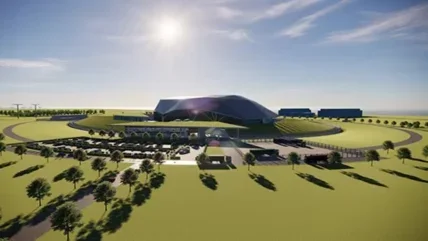

The plant consists of two primary structures: subterranean nuclear island; and above ground balance of plant.

Last Energy plans to contract out fabrication of its power plant modules to a company in Texas with experience in the oil and gas sector, and has built what it calls a “mechanical prototype (non-operational)” – essentially a mock-up – of the nuclear island.

“Because we are fully factory fabricated, we can begin building our power plant modules in parallel with the licensing process”, the company says, “employing industry standard components from existing supply chains.”

As mentioned, Last Energy proposes to use standard PWR fuel and components already in use in nuclear power plants around the world. But in miniaturising and modularising its SMR design, Last Energy says it has developed a “number of proprietary design elements, from passive heat removal systems to fully modularised structural components”, however, its “core expertise and differentiation comes in the integration of these design elements into a manufacturable and replicable product that can be mass produced.”

Last Energy says the PWR-20 uses multi-layer defence in depth passive safety features “to allow control in normal operations and fault scenarios, to prevent fault progression and provide heat removal and containment.”

To achieve this, “a small number of simple passive safety features are used – avoiding the need for complex engineered systems to maintain a safe state for the plant.”

Due to the small size, “engineered systems (such as containment) can be sized to withstand the most catastrophic event – which would be cost prohibitive for larger reactors.” Also “due to the small size of the reactor, the lower radionuclide inventory within, and the simple passive safety features, the worst case offsite dose is well within tolerable regulatory limits”, the company claims.

Last Energy says it is looking forward to seeing more details of the SMR competition to be organised by Great British Nuclear, a recently launched body tasked with driving the delivery of new nuclear power – and welcomes government support for SMRs – but emphasises that its “product and business model enable it to deliver using 100% private financing. We have not sought government grants in the development of the underlying technology, or subsidies in its deployment.”

How all this works out in practice remains to be seen of course.

BWRX-300 gathers momentum

Meanwhile, the GEH BWRX-300 seems to be making steady progress, a recent important step being the announcement that GE Hitachi Nuclear Energy, TVA, Ontario Power Generation (OPG) and Synthos Green Energy (SGE) of Poland are teaming up to advance its “global deployment” and under a technical collaboration agreement will invest in the development of a BWRX-300 standard design applicable in a range of jurisdictions and in detailed design of key components. GEH anticipates a total investment of around $400 million to arrive at the standard design and each contributor has agreed to fund a portion of GEH’s overall cost.

Site preparation is now underway for a BWRX-300 at OPG’s Darlington New Nuclear Project site in Clarington, Ontario, with construction expected to be complete by the end of 2028. This is on track to be the first grid-scale SMR in North America.

GEH says it has achieved a significant pre-licensing milestone in Canada with the completion of phases one and two of the Canadian Nuclear Safety Commission’s Vendor Design Review process, the first SMR technology to have completed two phases of the VDR process.

It also reports that SaskPower has selected the BWRX-300 for potential deployment in Saskatchewan in the mid-2030s.

In the USA, TVA is preparing a construction permit application for a BWRX-300 at the Clinch River Site near Oak Ridge, Tennessee and looking at other sites.

ORLEN Synthos Green Energy (OSGE), a JV between SGE and PKN Orlen, and partners have started a BWRX-300 pre-licensing process in Poland.

Fermi Energia has announced selection of selected the BWRX-300 for potential deployment in Estonia.

All in all, it can be said that the BWRX-300 seems to be gathering momentum worldwide.

Author: James Varley, Editor, Modern Power Systems