renewables

The power of the feed-in tariff

1 December 2008

Renewable energy is supported on grounds of energy security and climate change. However, investments in renewable sources of generation are capital-intensive, and require long periods to generate profit. The typical requirements of any programme to rapidly develop significant amounts of renewable energy are: the elimination of barriers to renewable generation; a stable market for renewable generation; and the stimulation of new investment in renewable generation.

Mechanisms need to be set up to encourage broad participation. They must typically be significant enough to act as viable financial incentives; long term enough to allow a market to be developed; and yet still affordable for government and consumers. Consequently, the prerequisites for successful policies include: the political desire for significant renewable generation; the willingness to pay the cost of renewable generation; and the stability of public policy to ensure that investors, lenders, and developers can earn a reasonable return on their investment.

Four generic support mechanisms can be identified for renewables: tariff based incentives; tax incentives; grants; and soft loans. Some typical financial support mechanisms are summarised in the table below.

Tariff based incentives provide renewable generators with advantageous and sometimes guaranteed off take arrangements, while tax incentives influence the return that can be expected of renewables projects. Grants can be made available at either local, regional, national or international levels (eg, EU, federal subsidy in the US) but are subject to project specifics. Soft loans provide investors with subsidised borrowing facilities.

Successful regimes

Feed-in tariffs have proved to be the most successful policy mechanism for the rapid development of renewable energy. Germany has used this policy to bolster development in wind, solar, and biomass energy. Other countries now use similar programmes, including Portugal, France, Switzerland, and Greece – and lately the UK for small projects.

Key features found in renewable support mechanisms are tariff differentiation by technology, project size, application, and resource intensity. In Germany, France, and Spain, the price paid is differentiated by technology, project size, application, location, and resource intensity. China, Germany, India and Spain all have local content programmes which drive growth in their manufacturing industries by insisting that a certain proportion of components or raw materials are sourced locally. More specifically, China issues RFPs with a local procurement requirement.

Spain employs a ‘hybrid system’, providing wind farm operators the option for a fixed feed in tariff or alternatively, the market rate (for wholesale electricity) plus a r29/MWh supplement. The market supplement is constrained by a floor and a cap.

The UK previously employed the Non-Fossil Fuel Obligation, which was abandoned due to insufficient capacity being put online. It was replaced by the Renewables Obligation (RO) policy through which RO certificates (ROCs) are provided for each MWh of electricity generated. To differentiate by technology, a ‘banded’ ROC system is due to be introduced in April 2009 in order to favour emerging technologies over established ones. Technologies are broken down into four categories, namely: Emerging (2.0 ROCs); Post-Demonstration (1.5 ROCs); Reference (1.0 ROC); and Established (0.5 ROC). For example, offshore and onshore wind are classed as Post-Demonstration and Reference technologies respectively.

The Green Certificate mechanism is a supplement to brown power, which is driven by varying oil and gas prices. In contrast, the feed-in tariff is a fixed payment mechanism. It would therefore insulate customers from rising oil and gas prices that inherently push up the electricity prices.

France and Germany employ tariffs with price ‘degression’ in each successive year of the programme. Each project receives the same price from one year to the next after the project is connected, but new projects coming online in succeeding years receive a lower price.

Successful programmes have historically employed either no cap on the programme size (eg, Germany), or such a high cap (eg, Spain) that there is little fear of reaching the cap in the early years of the programme. Caps induce uncertainty with regard to future financial returns and thus hinder investment in renewables.

US states typically employ a Renewable Portfolio Standard (RPS) to provide a legislative obligation on utilities to source power from renewables.

Value of support mechanisms

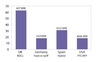

Interestingly, there is no direct correlation between the cost of a support mechanism and its effect on volume of capacity deployed (see graph above). Arguably, feed-in tariff mechanisms have been very effective, although they have provided less value for money than the US Production Tax Credit (PTC) system. The latter, however, has suffered from a stop/go pattern as its renewal is linked, unrealistically, to the electoral process and as a consequence the US has less manufacturing capacity than would be expected from the size of its market.

Feed-in mechanisms have been very effective in terms of stimulating domestic industry but it is noticeable that Green Certificate mechanisms, such as that in the UK, have been relatively poor value to the consumer.

The US PTC is currently in difficulty because of the lack of financial capacity to offset the credits available, whereas those countries with feed-in tariffs look best placed to deal with the credit crunch due to the relative security of income flows.

Interestingly, as a result of recent changes, the UK is now adopting the feed-in tariff – at least for small projects (below 5 MW). This could prove to be a welcome boost to the UK renewable energy industry, improving its resilience in a harsh economic climate.