The IEEFA (Institute for Energy Economics and Financial Analysis) reports that according to the latest Energy Information Administration estimate, US power producers have built up a ‘mountain’ of coal over the past two years that is sitting unused at their power plants. The stockpile, about 138 million tons at the end of November, is a likely headache for both utilities and coal producers alike. Worse, the EIA expects stockpiles to remain high, staying well over 100 million tons throughout 2025. For comparison, 138 million tons is the same amount of coal that the Appalachia coal fields would expect to produce in 2025.

At utilities, the huge stockpiles are both a storage and a financial headache. It amounts to $6.5 billion in unused inventory, based on a $47.22 per ton average cost of coal delivered to power plants (including transportation) from January through September 2024.

It has become problematic to burn that excess coal without losing money. Low gas prices, as well as increased solar and wind generation, have made coal-fired electricity less and less competitive. Periods with high electricity prices during summer heat waves and winter cold snaps also have become fewer, and further apart. As a result, US coal plants now collectively burn only 1 million tons a day, half as much as in 2015, based on the 12-month average through to September. At that rate, it would take power producers more than 4 months to use up all the stockpiled coal.

In the past when coal stockpiles soared, as happened in 2009, 2012, 2016, and again in 2020, power plant owners took up to 3 years to reduce them to a 50-60 day supply. This time may be different, because the scale is at a higher level than usual.

The problem for coal producers is that even if users continue to burn at the present rate coal production would need to fall dramatically, as 90% of all thermal coal mined in the USA is bought by power companies. EIA expects coal output to fall to 469 million tons in 2025, down from 505 million tons in 2024 and 578 million tons in 2023.

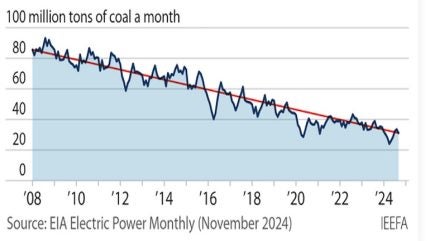

Coal deliveries have already been falling steadily for more than 15 years, from more than 80 million tons a month in 2008 to about 30 million a month in 2024. With huge stockpiles at power plants that utilities need to use, that trend looks set to continue in 2025, and could lead to some months with less than 20 million tons in deliveries.

Further, the US energy transition continues. IEEFA estimates that in 2025 another 13 GW of the remaining 173 GW of coal-fired capacity will either retire or be converted to gas, further reducing the market for coal.

Other factors include the fall in coal’s summer market share owing to an increase in power produced by utility-scale wind and solar – 665.8 million MWh – than coal for the first time, which will produce only 641.4 million MWh, according to the EIA’s November Short-Term Energy Outlook.

While gas generation, which overtook coal as the dominant fuel in 2016 and now delivers more than 40% of the country’s power, continues to push coal out of competitive power markets, especially when gas prices are below $3 per million British thermal units (mmBtu), as they have been for most of 2024. And if coal prices rise that will in itself drive more users towards renewables.

For more information: https://ieefa.org/resources/mountain-coal-us-power-plants-new-threat-coal-industry