Flexibility markets can help system operators and network utilities efficiently manage power flows through the network as industry demands become more complex. The markets manage when and where electricity is generated and consumed, incentivising the turn up and turn down of electricity demand or generation.

These markets can deal with the challenges of local constraint and curtailment management – increasingly common as the number of new distributed energy resources (DERs), community energy schemes, and demand response participants grow.

The UK government, in collaboration with Ofgem, has transitioned to a TotEX model and incentivised the use of more flexible arrangements, encouraging system operators to focus on performance objectives through the RIIO price control periods.

This has allowed the growth of an expansive ecosystem of market actors, all competing to provide:

- the best experience for flexibility service providers (FSPs); and

- the best flexibility solution according to the individual requirements of different system operators.

As the landscape continues to evolve, with more DERs connecting every day, market platforms need to be responsive, adaptive, and interconnected, so that system operators can maximise the benefits, avoid vendor lock-in, and provide an easy way for FSPs to offer their flexibility services into markets.

It’s in this context that Electron saw an opportunity to create more value for all market actors with its marketplace software for flexibility and distributed electricity.

Our configurable software-as-a-service platform, ElectronConnect, helps connect millions of distributed energy resources to thousands of co-ordinated markets, in response to these existing industry challenges – and in anticipation of the changing demands of a developing landscape.

An extensible multi-market solution

Electron has developed its extensible and configurable flexibility market platform to sit at the core of the evolving and interoperable flexibility ecosystem.

Through ElectronConnect, system operators can configure different market products and procure flexibility from different DER technology types and network levels – and across different time scales, ie, day-ahead to year-ahead. That means more visibility and more choice for system operators in how they procure flexibility.

That multitude of markets can also offer benefits to flexibility service providers. FSPs can “stack revenue” – or offer their services into different markets – incentivising them to participate in flexibility events and earn more.

The need for multi-market participation is growing, and Electron’s technology can keep pace, with automated processes and integrations to easily onboard FSPs. That FSP experience is key to the future of flexibility markets.

System operators need access to as many FSP options as possible to unlock the full potential of the network – and recent projects Electron has been involved in demonstrate that barriers can be broken down and modern, flexible markets can be deployed with concrete results.

For example, project TraDER, a first-of-its-kind, real-time physical local market.

Project TraDER

This project developed a flexibility market that was able to make more efficient use of the renewable electricity generated by wind farms in Orkney, Scotland.

Curtailment of wind power has cost UK households a total of £1.5bn since 2021, according to Carbon Tracker’s data. However, with project TraDER, ElectronConnect helped curtailed wind farms trade with local flexible demand assets at times of excess renewable energy generation. The local demand-side resources got paid to use the renewable energy, and the generators avoided curtailment.

To achieve this, a market was developed at the local level, where curtailed wind turbines could pay local demand-side resources to turn up their demand to soak up excess generation.

Behind that market, Electron helped develop processes that put the FSPs at the heart of the project.

With 24k micro-trades totalling 8.3 MWh during the project, trading was automated and demand assets were dispatched via APIs (application programming interfaces). The FSP participation therefore required minimal human intervention – which significantly increased participation. Near real-time responses to price signals were layered into the market design, to again boost asset participation.

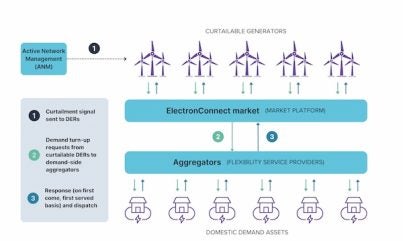

Trades were informed by curtailment signals sent to curtailable wind farms from the network’s active network management (ANM) system in real-time (see Figure 1).

These innovations allowed TraDER to deliver a new type of distribution-level market through ElectronConnect, which:

- operated in real time;

- allowed DERs to trade directly with one another – to increase their revenue streams and ensure more low-carbon energy is used; and

- gave visibility at the local level for demand turn-up requirements – all through one market platform.

This project was a precursor to a second stage, which is currently underway: project BiTraDER, a market for curtailment obligations trading.

Project BiTraDER

While TraDER tested a very specific use case – demand turn up in response to generation curtailment and in one specific network location – BiTraDER allows all four activities (demand turn up and turn down, generation turn up and turn down) to be offered into the market, depending on the constraint type. It can also cover multiple locations, or even the whole DSO network, and is technology-agnostic. These factors increase the volume of flexibility that can be procured.

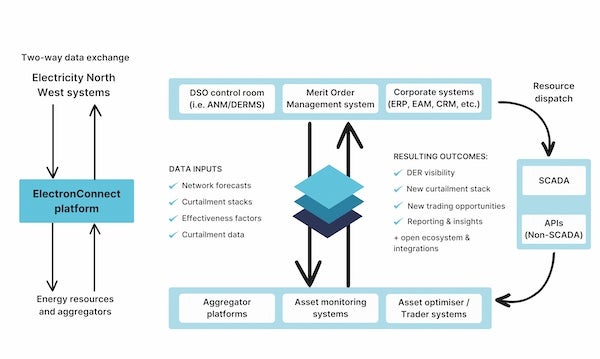

Most importantly, in the ongoing BiTraDER project, information flows in both directions – from the ANM to the trading platform and back to the ANM. The project will therefore create a blueprint for scaling and integrating third-party market platforms with network operating systems, to increase the use of flexibility markets and facilitate those bilateral data flows.

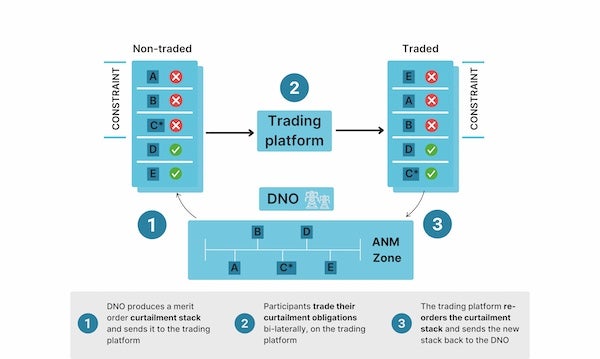

To test this blueprint, an asset-to-asset – or many-to-many – market for local curtailment obligations trading will be established (see Figure 2). In this market, the system operator will produce and share with the trading platform a list of predicted constraints up to 48 hours ahead and the DER curtailment queue – the “merit order stack”.

The DERs that are predicted to be curtailed can pay another DER to take their place in the curtailment queue, through ElectronConnect’s flexibility marketplaces. Flexibility sellers – the non-curtailable assets – set the price at which they agree to be curtailed in the event of a constraint. Flexibility buyers – or the curtailable assets – set the maximum price they are willing to pay to buy their way out of a constraint.

The system operator, while acting neutrally in this market, benefits from the market as it makes curtailable connections more attractive and allows them to connect more DERs onto parts of the grid with high levels of constraints, faster.

This once again delivers on the industry’s need for more clean, low-carbon energy with access to more data insights – and value – for buyers, sellers, and managers of flexibility.

This is possible with new integrations between ElectronConnect, Electricity North West’s network management systems, and other services to enable two-way data flows (see Figure 3). Those data flows enable a level of interoperability that’s critical as the ecosystem for flexibility continues to evolve.

Managing network constraints

These projects exemplify the importance of flexibility market platforms, such as ElectronConnect, in helping meet national decarbonisation targets and resolving industry-level operational challenges in managing the constraints on the network – and in procuring flexibility in the most efficient and cost-effective manner.

Author: Emilis Srage Product Manager, Electron, UK